A Quick Look

I. Introduction

A. Overview of Credit Cards

Credit cards have become indispensable tools in the modern financial landscape. Beyond their basic function of facilitating transactions, they offer a myriad of benefits, including rewards, travel perks, and purchase protections. For businesses, especially, the right credit card can provide vital support for cash flow management, expense tracking, and earning significant rewards that can be reinvested into the business.

B. Importance of Choosing the Right Card

Selecting the right credit card is more than just a financial decision; it’s a strategic one. The card you choose can impact your business’s operational efficiency, financial health, and overall growth. With countless options on the market, each tailored to different needs and lifestyles, understanding the specific benefits and drawbacks of each card is crucial. Factors such as annual fees, interest rates, rewards programs, and additional benefits should be weighed carefully to ensure that the card aligns perfectly with your business objectives and spending habits.

C. Introduction to The Business Platinum Card® from American Express

Among the myriad of credit card options available, The Business Platinum Card® from American Express stands out as a top-tier choice for discerning business owners. Renowned for its comprehensive rewards program, extensive travel benefits, and unparalleled customer service, this card is designed to cater to businesses that demand the best. But what truly sets it apart is its combination of lucrative welcome gifts and exclusive perks that provide value far beyond the typical offerings. In this article, we will delve into the intricate details of The Business Platinum Card® from American Express, exploring its features, benefits, and how it compares to other cards in the market, to help you determine if it is the right fit for your business.

II. Features of The Business Platinum Card®

When it comes to premium business credit cards, The Business Platinum Card® from American Express stands out as a beacon of luxury and value. This section delves into the card’s myriad features, designed to cater to the sophisticated needs of business professionals. From a robust rewards program to an enticing welcome gift and exclusive benefits, this card offers a comprehensive suite of features that are hard to match.

A. Rewards Program

1. Membership Rewards® Points

The Business Platinum Card® offers a highly lucrative rewards program through Membership Rewards® points. Cardholders can earn 5X points on flights and prepaid hotels booked through the American Express Travel website, and 1.5X points on eligible purchases at U.S. construction material and hardware suppliers, electronic goods retailers, software and cloud system providers, and shipping providers, as well as on purchases of $5,000 or more everywhere else, on up to $2 million of these purchases per calendar year. All other purchases earn 1X point per dollar spent. This rewards structure is designed to maximize the value for business expenses, making it easier for cardholders to accumulate points quickly.

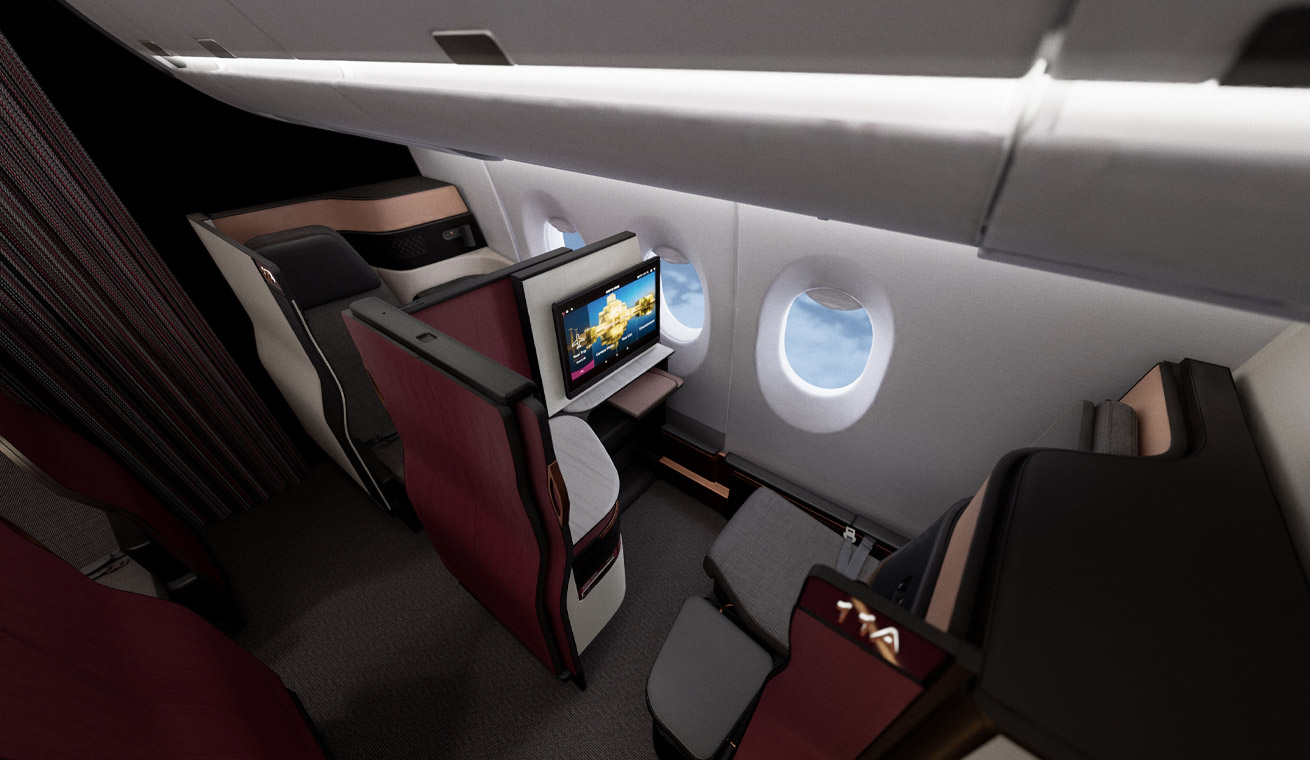

2. Travel Benefits

The card is a treasure trove for frequent travelers. In addition to earning points, cardholders enjoy a plethora of travel benefits, including a $200 airline fee credit, which can be used for incidental fees such as checked bags and in-flight refreshments. Additionally, the card provides up to $200 in annual statement credits for U.S. purchases with Dell Technologies. Moreover, the Global Lounge Collection grants access to over 1,300 airport lounges worldwide, ensuring that travel is as comfortable as possible.

3. Purchase Protections

Business purchases often involve high costs and significant risks. The Business Platinum Card® offers purchase protections that provide peace of mind. This includes extended warranty protection, which extends the manufacturer’s warranty by an additional year on eligible purchases. Additionally, the card offers purchase protection that can cover new purchases against damage or theft for up to 90 days and up to $10,000 per occurrence, with a maximum of $50,000 per calendar year.

B. Welcome Gift

1. Description of the Welcome Offer

One of the standout features of The Business Platinum Card® is its generous welcome offer. New cardholders can earn up to 120,000 Membership Rewards® points after spending $15,000 on eligible purchases within the first three months of card membership. This significant boost can be a game-changer, providing immediate value that can be redeemed for travel, gift cards, or statement credits.

2. How to Qualify

Qualifying for the welcome offer requires meeting the spending threshold within the specified timeframe. Eligible purchases include most transactions, excluding fees or interest charges, balance transfers, and cash advances. To ensure you meet the requirement, consider using the card for large business expenses, recurring bills, or planned investments.

3. Best Practices to Maximize the Welcome Gift

To maximize the welcome gift, plan your spending strategically. Focus on high-spending categories that earn additional points, such as travel and large purchases. Track your spending to ensure you hit the $15,000 mark within the first three months. Additionally, consider timing your application to coincide with major business expenses or investments to make meeting the threshold easier.

C. Exclusive Benefits

1. Airport Lounge Access

One of the most coveted perks of The Business Platinum Card® is its comprehensive airport lounge access. Cardholders enjoy entry to the American Express Centurion Lounges, Delta Sky Clubs (when flying Delta), Priority Pass Select lounges, and other exclusive airport lounges worldwide. This benefit transforms travel experiences by providing a comfortable space to relax, work, or refresh before flights.

2. Hotel Benefits

The card also extends exclusive benefits to enhance hotel stays. Cardholders receive complimentary Gold Elite Status in the Marriott Bonvoy and Hilton Honors programs, which includes perks such as room upgrades (when available), late checkout, and bonus points on stays. Additionally, the Fine Hotels & Resorts program offers benefits such as daily breakfast for two, guaranteed 4 PM late checkout, room upgrades when available, and unique property amenities worth an average total value of $550 per stay.

3. Concierge Services

For those who appreciate personalized assistance, the American Express Business Platinum Concierge is a valuable resource. This 24/7 service can help with a range of requests, from booking travel and dining reservations to securing event tickets and providing recommendations for local services. It’s like having a personal assistant at your disposal, ensuring that your business and personal needs are seamlessly managed.

In summary, The Business Platinum Card® from American Express offers a robust suite of features that cater to the demanding needs of business professionals. Its rewarding points program, substantial welcome gift, and exclusive benefits make it a compelling choice for those seeking a premium business credit card.

III. Comparing The Business Platinum Card® with Other Cards

Selecting the right credit card for your business is crucial. The Business Platinum Card® from American Express offers a suite of benefits designed to cater to elite business travelers and high spenders, but how does it stack up against other premium business cards, cash back cards, and travel cards? Let’s dive into a detailed comparison to see where it excels and where it might fall short.

A. Comparison with Other Premium Business Cards

1. Benefits Comparison

The Business Platinum Card® is renowned for its extensive benefits. It offers a robust rewards program through Membership Rewards® points, which can be redeemed for travel, gift cards, and more. Additionally, cardholders enjoy a plethora of travel benefits such as access to over 1,300 airport lounges worldwide through the Global Lounge Collection, and up to $200 in annual airline fee credits.

In comparison, the Chase Ink Business Preferred® Credit Card also offers lucrative rewards but focuses more on points for purchases related to travel and select business categories. While it provides valuable travel protections and no foreign transaction fees, it lacks the extensive lounge access and concierge services that come with The Business Platinum Card®.

2. Fee Comparison

Premium business cards usually come with hefty annual fees, and The Business Platinum Card® is no exception, clocking in at $695 per year. This fee is justified by its extensive benefits and rewards. However, the Chase Ink Business Preferred® Credit Card has a significantly lower annual fee of $95, making it a more affordable option for businesses that don’t need the high-end travel perks of The Business Platinum Card®.

3. Customer Service

American Express is often lauded for its exceptional customer service, offering 24/7 support and a dedicated team for business cardholders. The Business Platinum Card® includes access to specialized business consultants and a concierge service. While other premium cards like the Chase Ink Business Preferred® also offer strong customer service, the level of personalized and specialized support provided by American Express is hard to beat.

B. Comparison with Cash Back Cards

1. Rewards Structure

The Business Platinum Card® focuses on earning Membership Rewards® points, which can be highly valuable when redeemed for travel or transferred to airline and hotel partners. In contrast, cash back cards like the Capital One® Spark® Cash for Business offer straightforward cash back rewards, typically around 2% on all purchases. For businesses that prefer simplicity and immediate rewards, a cash back card might be more appealing.

2. Annual Fees

Cash back cards generally come with lower annual fees compared to premium cards. The Capital One® Spark® Cash for Business, for example, has a $0 introductory annual fee for the first year, then $95 thereafter. This is a stark contrast to the $695 annual fee of The Business Platinum Card®. Businesses must consider whether the extensive benefits of The Business Platinum Card® justify the higher cost.

3. Suitability for Different Business Types

The Business Platinum Card® is ideal for businesses with significant travel expenses and those that can leverage its extensive travel perks and rewards program. On the other hand, cash back cards are better suited for businesses looking for simplicity and consistent, tangible rewards. Companies with high operating expenses in diverse categories may find cash back cards more beneficial due to their straightforward rewards structure.

C. Comparison with Travel Cards

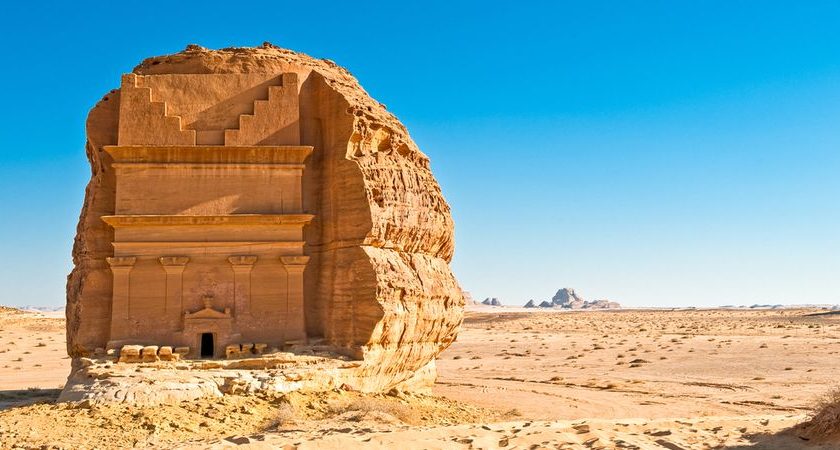

1. Travel Perks

The Business Platinum Card® is a powerhouse when it comes to travel perks. In addition to lounge access and airline fee credits, it offers benefits like a Global Entry or TSA Pre✓® fee credit and elite status with Marriott Bonvoy and Hilton Honors. Travel cards like the Chase Sapphire Reserve® also offer impressive travel benefits, including a $300 annual travel credit and Priority Pass™ Select lounge access. However, The Business Platinum Card® often edges out competitors with a broader range of perks and services tailored for frequent travelers.

2. Point Redemption Options

Membership Rewards® points from The Business Platinum Card® can be redeemed in various ways, including for flights, hotels, upgrades, and even merchandise. Travel cards like the Chase Sapphire Reserve® offer similar versatility, allowing points to be transferred to numerous travel partners or redeemed through the Chase Ultimate Rewards® portal. The choice between these cards often comes down to which loyalty programs and redemption options align best with the cardholder’s preferences and travel habits.

3. Global Acceptance

Both The Business Platinum Card® and other top-tier travel cards like the Chase Sapphire Reserve® are widely accepted globally. However, Visa and Mastercard, such as the latter, may have a slight edge in acceptance over American Express in some international markets. Businesses with significant international travel should consider this factor when choosing a card.

IV. Conclusion

A. Summary of Key Points

The Business Platinum Card® from American Express stands out as a premium option for business owners and frequent travelers seeking unparalleled benefits and rewards. Throughout this analysis, we’ve delved into the card’s robust features, including its comprehensive rewards program that allows cardholders to accumulate Membership Rewards® points, enjoy extensive travel benefits, and benefit from purchase protections. The welcome gift associated with the card is particularly enticing, offering substantial value that can be maximized through strategic use. Additionally, the card’s exclusive benefits, such as airport lounge access, hotel perks, and concierge services, further enhance its appeal.

B. Final Thoughts on The Business Platinum Card®

Choosing the right credit card for your business is a critical decision that can significantly impact your financial management and travel experiences. The Business Platinum Card® from American Express excels in offering a suite of premium features that cater to high-spending business owners who prioritize luxury, convenience, and exceptional service. Its high annual fee is justified by the extensive array of benefits and rewards that can lead to significant savings and elevated experiences, particularly for those who travel frequently and make substantial business purchases.

C. Recommendation for Potential Cardholders

For business owners who frequently travel, value high-end perks, and seek to maximize rewards, The Business Platinum Card® from American Express is an excellent choice. It offers unmatched travel benefits, a generous welcome gift, and a host of exclusive features that can greatly enhance your business operations and travel experiences. However, it’s essential to weigh the card’s annual fee against the benefits you expect to use. If the extensive travel perks, rewards, and protections align with your business needs and spending habits, this card can be a powerful tool in your financial arsenal. Conversely, if your business expenditures and travel patterns do not justify the high annual fee, you might consider other premium or cash back cards that better suit your specific needs.

In conclusion, The Business Platinum Card® from American Express is a top-tier option for discerning business owners who demand the best in rewards, travel benefits, and exclusive services. By carefully evaluating your business’s financial habits and travel requirements, you can make an informed decision that maximizes the value and utility of this prestigious card.

Catch up on the top stories and travel deals by subscribing to our newsletter!