A Quick Look

I. Introduction

A. Overview of the Ink Business Preferred® Credit Card

In the dynamic world of business, having a reliable and rewarding credit card can make a significant difference. The Ink Business Preferred® Credit Card, issued by Chase, is designed to cater to the unique needs of business owners. Known for its robust rewards program and valuable perks, this card has become a popular choice among entrepreneurs and small business owners alike. Whether you’re managing daily expenses, traveling for business, or investing in your company’s growth, the Ink Business Preferred® Credit Card offers a range of features that can help you maximize your spending power.

B. Importance of Understanding Credit Card Benefits

Navigating the vast landscape of business credit cards can be daunting, but understanding the specific benefits and drawbacks of each option is crucial. Selecting the right card can lead to substantial savings, improved cash flow, and enhanced financial management for your business. Conversely, choosing a card that doesn’t align with your spending habits and business needs can result in missed opportunities and unnecessary costs. Therefore, a thorough analysis of the Ink Business Preferred® Credit Card’s features is essential for making an informed decision.

C. Brief Mention of the Welcome Gift

One of the standout features of the Ink Business Preferred® Credit Card is its generous welcome gift. New cardholders have the opportunity to earn a substantial bonus, which can provide a significant boost to your rewards balance right from the start. In the next section, we’ll delve into the specifics of this enticing welcome offer, including how to qualify and claim it, setting the stage for evaluating the overall value of the card.

II. Welcome Gift Details

A. Description of the Welcome Gift

The Ink Business Preferred® Credit Card’s generous welcome gift is designed to attract savvy business owners who are looking to maximize their credit card benefits right from the start. New cardholders can earn a substantial 100,000 bonus points after spending $15,000 on purchases within the first three months from account opening. These points can be incredibly valuable, translating to $1,000 in cash back or $1,250 toward travel when redeemed through the Chase Ultimate Rewards® portal. This welcome gift sets a strong foundation for accumulating rewards and offers a significant initial boost to your points balance.

B. Eligibility Criteria

To qualify for this enticing welcome gift, there are a few criteria that applicants must meet:

- New Cardholders Only: The offer is available exclusively to new Ink Business Preferred® Credit Card members. If you already hold this card or have received a new cardmember bonus for this card within the past 24 months, you are not eligible for the welcome gift.

- Spending Requirement: You must spend $15,000 on purchases within the first three months of opening your account. This includes a wide range of business expenses, from office supplies to client dinners, making it achievable for many business owners.

- Creditworthiness: As with any credit card application, your approval and eligibility for the welcome gift are subject to a review of your creditworthiness. This includes your credit score, income, and overall financial health.

C. How to Claim the Welcome Gift

Claiming the welcome gift is straightforward, provided you meet the eligibility criteria. Here’s how you can ensure that you receive your 100,000 bonus points:

- Apply for the Card: Begin by applying for the Ink Business Preferred® Credit Card. Ensure you provide accurate and complete information to avoid any delays in processing your application.

- Meet the Spending Requirement: Once your card is approved and activated, focus on meeting the $15,000 spending requirement within the first three months. Track your spending via the Chase mobile app or online banking to ensure you stay on target.

- Monitor Your Account: After meeting the spending threshold, the bonus points will typically be credited to your account within 6 to 8 weeks. You can monitor your points balance through your online account or the Chase mobile app.

- Redeem Your Points: Once the points are credited, you can redeem them through the Chase Ultimate Rewards® portal. You have the flexibility to choose from various redemption options, including travel, cash back, gift cards, and more. For maximum value, consider using the points for travel bookings, where 100,000 points equate to $1,250 in travel expenses.

By understanding and leveraging the welcome gift of the Ink Business Preferred® Credit Card, new cardholders can kickstart their rewards journey with a substantial points balance, setting the stage for ongoing benefits and value.

III. Pros of the Ink Business Preferred® Credit Card

When it comes to selecting a credit card that aligns with your business needs, the Ink Business Preferred® Credit Card stands out for several compelling reasons. Here, we delve into the primary advantages that make this card a strong contender for business owners.

A. High Rewards Rate on Business Purchases

One of the most attractive features of the Ink Business Preferred® Credit Card is its high rewards rate on business-related purchases. Cardholders earn 3 points per $1 on the first $150,000 spent in combined purchases on travel, shipping purchases, internet, cable and phone services, and advertising purchases made with social media sites and search engines each account anniversary year. For all other purchases, cardholders earn 1 point per $1 spent. This rewards structure is particularly beneficial for businesses with significant expenditures in these categories, allowing them to maximize their return on everyday expenses.

B. Flexibility in Redeeming Points

The flexibility in redeeming points is another significant advantage of the Ink Business Preferred® Credit Card. Points can be redeemed in various ways, including travel, cash back, gift cards, and products or services through the Chase Ultimate Rewards® portal. Notably, when points are redeemed for travel through the Ultimate Rewards® portal, they are worth 25% more—making this an excellent option for businesses that value travel perks. This flexibility ensures that cardholders can tailor their rewards to meet their specific business needs and goals.

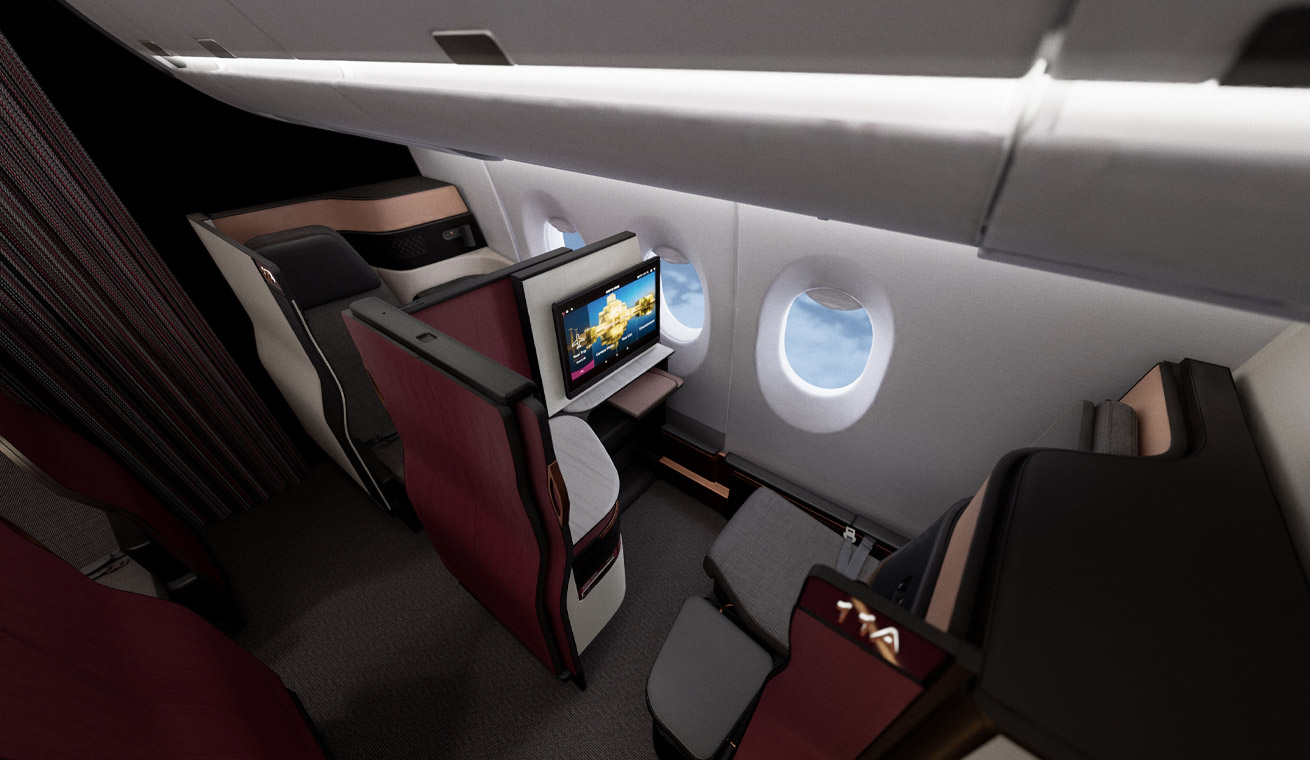

C. Comprehensive Travel Insurance Benefits

For businesses that involve frequent travel, the Ink Business Preferred® Credit Card offers comprehensive travel insurance benefits that can provide peace of mind and significant savings. These benefits include trip cancellation/interruption insurance, auto rental collision damage waiver, and travel accident insurance. Additionally, cardholders can take advantage of trip delay reimbursement and baggage delay insurance. These protections can cover unexpected expenses and inconveniences, making business travel smoother and less stressful.

In summary, the Ink Business Preferred® Credit Card offers robust rewards and flexible redemption options, along with extensive travel insurance benefits that cater to the diverse needs of business owners. These pros make it an appealing option for those looking to maximize their business expenditures and travel experiences.

IV. Cons of the Ink Business Preferred® Credit Card

While the Ink Business Preferred® Credit Card certainly offers a suite of attractive benefits, it is not without its drawbacks. Prospective cardholders should be aware of the following cons before making their decision:

A. High Annual Fee

One of the most significant downsides of the Ink Business Preferred® Credit Card is its high annual fee. At $95 per year, this fee can be a considerable expense, especially for small business owners who are mindful of their budgets. While the card’s benefits and rewards can offset this cost for some users, others may find it challenging to justify the expense, particularly if they do not maximize the card’s rewards and perks.

B. Limited Categories for Earning Higher Rewards

Although the Ink Business Preferred® Credit Card boasts a high rewards rate in specific business-related categories, these categories are somewhat limited. Cardholders earn 3 points per dollar on the first $150,000 spent in combined purchases on travel, shipping purchases, internet, cable, and phone services, and advertising purchases made with social media sites and search engines each account anniversary year. However, for all other purchases, the rewards rate drops to just 1 point per dollar. This can be a drawback for businesses with significant expenses outside these specific categories, as they may not earn as many rewards as they would with a card that offers higher rates on a broader range of purchases.

C. Potential for Overspending

Another potential downside of the Ink Business Preferred® Credit Card is the risk of overspending. The allure of earning rewards points can sometimes lead cardholders to make unnecessary purchases or spend beyond their means. This is a common pitfall for many rewards credit cards, but it can be particularly problematic for small business owners who need to manage their cash flow carefully. Overspending can lead to increased debt and interest charges, which can negate the benefits of the rewards earned.

V. Conclusion

A. Summary of Pros and Cons

The Ink Business Preferred® Credit Card offers a robust suite of benefits that can significantly enhance the financial toolkit of any small business owner. On the positive side, the card boasts a high rewards rate on business-related purchases, which can translate into substantial savings and value over time. Additionally, the flexibility in redeeming points allows cardholders to tailor their rewards to their specific needs, whether those be travel, cash back, or other redemption options. The comprehensive travel insurance benefits add another layer of security, making this card particularly appealing for businesses with frequent travel requirements.

However, the card is not without its drawbacks. The high annual fee may deter some business owners, especially those with tighter budgets or lower spending levels. Additionally, the rewards structure, while generous, is limited to specific categories, which could be a disadvantage for businesses with diverse spending patterns. Lastly, the potential for overspending, driven by the lure of earning more points, is a risk that cardholders need to manage carefully.

B. Final Thoughts on the Ink Business Preferred® Credit Card

The Ink Business Preferred® Credit Card stands out as a powerful financial tool for small business owners who can maximize its rewards and benefits. Its high rewards rates and flexible redemption options make it a versatile choice, while the travel insurance benefits provide peace of mind for business travelers. However, the high annual fee and limited reward categories are crucial considerations that potential cardholders must weigh.

C. Recommendations for Potential Cardholders

For potential cardholders, the decision to apply for the Ink Business Preferred® Credit Card should be based on an honest assessment of your business’s spending habits and financial needs. If your business frequently incurs expenses in the card’s high-reward categories and you can leverage the comprehensive travel benefits, the card could offer exceptional value despite the annual fee. Conversely, if your spending is more varied or if the annual fee outweighs the possible rewards, you might want to explore other options that align more closely with your financial habits and goals.

Ultimately, the Ink Business Preferred® Credit Card is a formidable option for the right business. By carefully considering your specific needs and financial situation, you can determine whether this card is the ideal fit for you, ensuring that you fully capitalize on its numerous advantages while mitigating its potential downsides.

Catch up on the top stories and travel deals by subscribing to our newsletter!