Table of contents

I. Introduction

A. Brief Overview of Citi Strata Premier℠ Card

In the dynamic world of credit cards, the Citi Strata Premier℠ Card emerges as a notable contender, offering a blend of enticing rewards and comprehensive benefits. This card, crafted by WentWorld and powered by Citi, promises to cater to the diverse needs of modern consumers, from avid travelers to everyday spenders. With its eye-catching welcome gift and a suite of features, the Citi Strata Premier℠ Card stands out as a potential game-changer in the credit card market.

B. Importance of Analyzing Credit Cards

In today’s financially intricate landscape, the importance of meticulously analyzing credit cards cannot be overstated. Choosing the right credit card goes beyond the allure of introductory offers and flashy advertisements; it requires a deep dive into the card’s long-term value proposition. Factors such as reward points, annual fees, interest rates, and customer service play a crucial role in determining whether a credit card aligns with an individual’s financial goals and lifestyle. A comprehensive analysis helps consumers make informed decisions, ensuring they maximize benefits while minimizing costs.

C. Preview of Welcome Gift and Main Features

One of the most compelling aspects of the Citi Strata Premier℠ Card is its generous welcome gift, designed to attract new cardholders. In this article, we will begin by delving into the specifics of this welcome gift, including its description, eligibility criteria, and the associated pros and cons. Following this, we will explore the main features of the card, highlighting both its strengths and potential drawbacks. By providing a balanced analysis, we aim to equip you with the necessary insights to determine if the Citi Strata Premier℠ Card is the right fit for your financial needs.

In the sections that follow, expect a detailed breakdown of the card’s rewards, travel perks, customer service quality, and more. We’ll also critically assess the costs associated with the card, such as annual fees and interest rates, as well as any limitations in its acceptance and the complexity of its reward redemption process. So, let’s embark on this detailed journey to uncover the true value of the Citi Strata Premier℠ Card.

II. Welcome Gift

A. Description of the Welcome Gift

One of the most enticing aspects of the Citi Strata Premier℠ Card is its generous welcome gift, designed to attract new cardholders. Upon approval and meeting the initial spending requirement, new cardholders are greeted with a substantial bonus in the form of reward points. Specifically, you can earn 50,000 bonus points after spending $3,000 within the first three months of account opening. These points can be redeemed for a variety of rewards, including travel, merchandise, and statement credits, offering a flexible and valuable incentive for new users.

B. Eligibility Criteria for the Welcome Gift

To qualify for this attractive welcome gift, cardholders must meet specific criteria. Firstly, the $3,000 spending requirement must be fulfilled within the first three months of account opening. Additionally, applicants must ensure that their credit score meets the approval standards set by Citi, typically falling into the good to excellent range. Importantly, individuals who have opened or closed a Citi Strata Premier℠ Card in the past 24 months are not eligible for the welcome gift, a stipulation set to prevent abuse of the bonus offer.

C. Pros and Cons of the Welcome Gift

Pros:

- High Value: The 50,000 bonus points can equate to significant monetary value, especially when redeemed for travel. This makes the welcome gift a lucrative incentive for frequent travelers or those planning a big purchase.

- Flexible Redemption Options: The points earned through the welcome gift can be used in various ways, providing flexibility. Whether you prefer travel rewards, merchandise, or simple statement credits, the choice is yours.

- Motivation to Spend: The spending requirement encourages new cardholders to use their card for everyday purchases, helping them to quickly familiarize themselves with the card’s features and benefits.

Cons:

- Spending Requirement: The need to spend $3,000 within three months might be challenging for some users, particularly those with lower monthly expenses or those who are cautious with credit card spending.

- Eligibility Restrictions: The exclusion of previous cardholders from the welcome gift eligibility, if they’ve opened or closed an account in the past 24 months, can be a drawback for returning customers or those who frequently switch cards for rewards.

- Potential for Overspending: To meet the spending requirement, some users might be tempted to spend more than they usually would, which could lead to financial strain or increased debt if not managed carefully.

In summary, the welcome gift offered by the Citi Strata Premier℠ Card is a significant draw for new cardholders, providing a high-value incentive to meet initial spending requirements. While the potential benefits are substantial, prospective users should carefully consider their spending habits and eligibility to ensure this welcome gift aligns with their financial situation and goals.

III. Pros of Citi Strata Premier℠ Card

When evaluating credit cards, understanding the benefits can significantly impact your decision-making process. The Citi Strata Premier℠ Card offers a range of advantages that cater to various consumer needs, from rewards and travel perks to customer support. Here’s an in-depth look at some of the standout pros of this card:

A. Reward Points and Benefits

One of the most compelling features of the Citi Strata Premier℠ Card is its robust rewards program. Cardholders earn points on every purchase, making it easy to accumulate rewards quickly. Here are some key highlights:

- Generous Points Accumulation: Earn 3 points per dollar spent on travel and dining, 2 points on entertainment, and 1 point on all other purchases. This tiered system allows users to maximize their points in categories where they spend the most.

- Bonus Points Opportunities: Occasionally, Citi offers promotions where cardholders can earn additional bonus points for spending in specific categories or during designated periods.

- Flexible Redemption Options: Points can be redeemed for a variety of rewards, including travel, merchandise, gift cards, and statement credits, providing flexibility to suit different preferences.

B. Travel Perks and Insurance

For frequent travelers, the Citi Strata Premier℠ Card offers a suite of travel-related benefits that can enhance the overall travel experience and provide peace of mind:

- Travel Insurance: The card includes comprehensive travel insurance that covers trip cancellations, interruptions, and delays. This feature is invaluable for safeguarding travel investments against unforeseen circumstances.

- Lost Luggage Reimbursement: Cardholders are eligible for reimbursement if their luggage is lost or delayed, reducing the stress associated with travel mishaps.

- No Foreign Transaction Fees: When traveling abroad, cardholders won’t incur additional fees for transactions made in foreign currencies, making it a cost-effective option for international use.

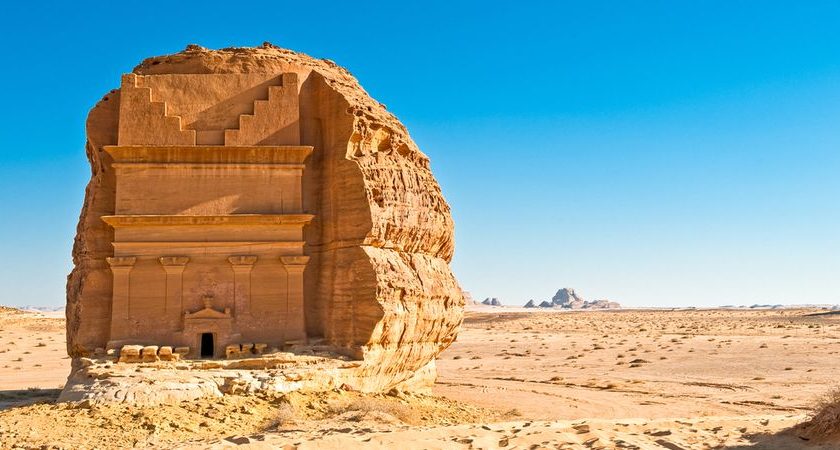

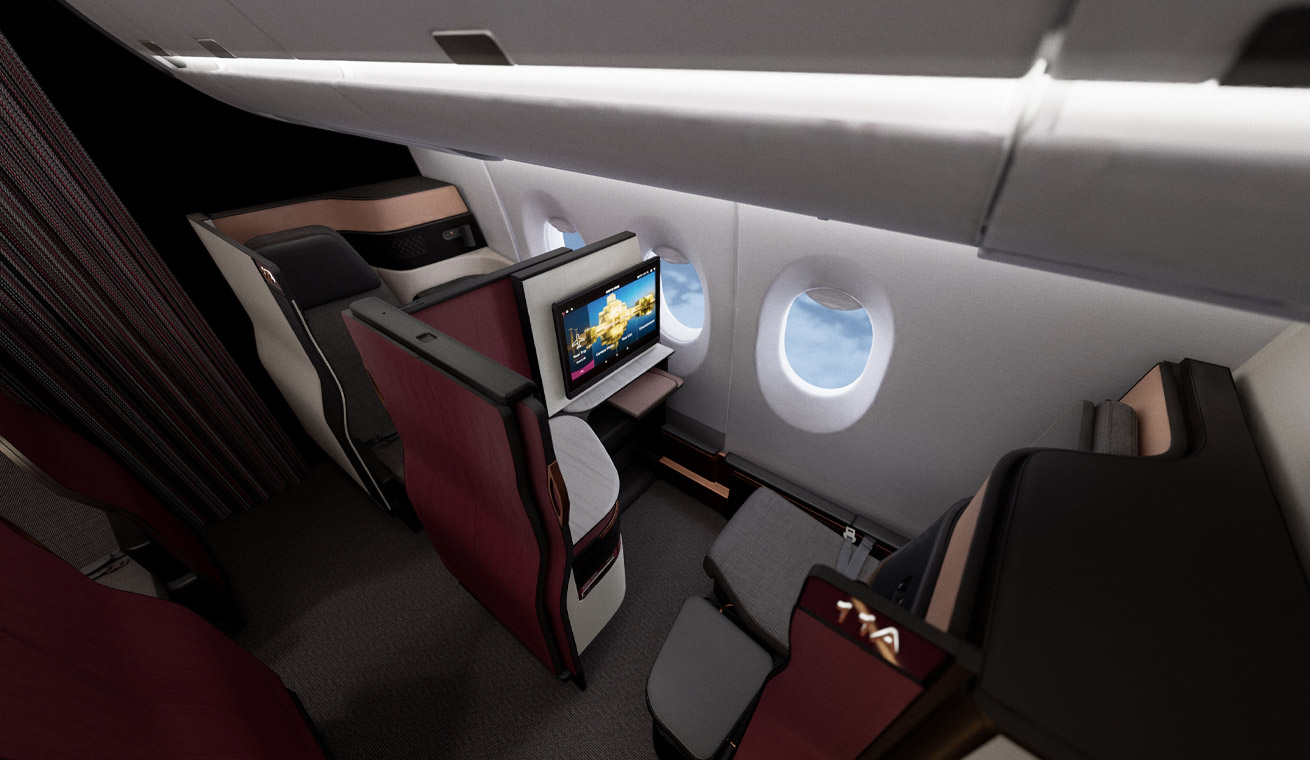

- Airport Lounge Access: Some versions of the card provide complimentary access to airport lounges, offering a more comfortable and serene environment while waiting for flights.

C. Customer Service and Support

Exceptional customer service is a crucial factor when choosing a credit card, and the Citi Strata Premier℠ Card excels in this area:

- 24/7 Customer Support: Cardholders have access to round-the-clock customer service, ensuring assistance is always available, no matter the time zone or situation.

- Concierge Services: The card offers personalized concierge services to help with travel arrangements, dining reservations, event tickets, and more, adding a touch of luxury to everyday experiences.

- Fraud Protection: Citi employs advanced security measures to monitor for fraudulent activity, and cardholders are not held responsible for unauthorized charges. This provides an added layer of security and peace of mind.

Overall, the Citi Strata Premier℠ Card offers a multitude of benefits that cater to various lifestyles and spending habits. Its rewards program, travel perks, and dedicated customer service make it a strong contender in the credit card market.

IV. Cons of Citi Strata Premier℠ Card

While the Citi Strata Premier℠ Card offers a range of enticing benefits, it’s essential to weigh these against the potential drawbacks to make an informed decision. Here, we delve into some of the cons associated with this credit card.

A. Annual Fees and Interest Rates

One of the primary considerations for any credit card is the cost of ownership, and the Citi Strata Premier℠ Card is no exception. The card carries a relatively high annual fee, which may deter budget-conscious consumers. This fee can quickly offset the value of the rewards and benefits if you don’t maximize the card’s offerings.

Moreover, the interest rates on the Citi Strata Premier℠ Card are on the higher side compared to some of its competitors. If you tend to carry a balance from month to month, the accruing interest could significantly increase your overall debt, making this card a less attractive option for those who don’t pay off their balance in full every billing cycle.

B. Limited Acceptance in Some Locations

Despite being a product of Citi, a globally recognized financial institution, the Citi Strata Premier℠ Card may not be universally accepted. In certain international destinations or small businesses, you might find that this card is not a viable payment option. This limitation can be particularly inconvenient for frequent travelers who rely on their credit card for seamless transactions abroad.

Additionally, some domestic merchants may prefer other credit card networks, which could potentially restrict your purchasing options. This limited acceptance can undermine the convenience and utility of the card, making it less versatile than other options on the market.

C. Complex Reward Redemption Process

Another downside of the Citi Strata Premier℠ Card is its somewhat convoluted reward redemption process. While the card offers a plethora of reward points, navigating the redemption system can be a daunting task. The process often involves multiple steps and specific conditions that must be met, which can be frustrating for users who prefer a straightforward approach.

Moreover, the value of reward points may vary depending on how and when they are redeemed. This variability can make it challenging to maximize the benefits of the rewards program. Users might find themselves spending an inordinate amount of time trying to figure out the best way to use their points, which detracts from the overall user experience.

V. Conclusion

A. Summary of Pros and Cons

The Citi Strata Premier℠ Card presents a well-rounded option for consumers seeking a credit card that offers significant rewards and travel perks. On the positive side, the card boasts a robust rewards program, providing ample opportunities to accrue points through everyday spending and special categories. Travel enthusiasts will appreciate the array of travel benefits, including travel insurance, airport lounge access, and no foreign transaction fees. Additionally, Citi’s reputation for excellent customer service adds a layer of reassurance for cardholders.

However, the card is not without its drawbacks. The annual fee, which is on the higher end of the spectrum, may deter some potential users, especially those who may not fully utilize the card’s benefits. The interest rates are also worth considering, as they can add up quickly if balances are not paid in full each month. Furthermore, the card’s acceptance may be limited in some locations, particularly overseas, which could pose challenges for frequent travelers. Lastly, the reward redemption process can be complex and may require a steep learning curve for new users.

B. Final Thoughts on Citi Strata Premier℠ Card

The Citi Strata Premier℠ Card is undeniably a compelling option for those who can maximize its rewards and benefits. It offers a comprehensive suite of features designed to appeal to a variety of users, from casual spenders to avid travelers. The welcome gift, while attractive, also comes with eligibility criteria that potential users should carefully review.

For individuals who prioritize travel perks, robust customer service, and a generous rewards program, this card is likely to deliver substantial value. However, those who are deterred by high annual fees or who may find the reward redemption process cumbersome should weigh these factors carefully before committing.

C. Recommendation for Potential Users

In conclusion, the Citi Strata Premier℠ Card is best suited for users who are able to leverage its extensive benefits and who do not mind navigating a more complex rewards system. If you frequently travel, can comfortably manage an annual fee, and value top-notch customer service, this card could be a valuable addition to your wallet. However, if you prefer a card with lower fees and a simpler rewards structure, you might want to explore other options.

By carefully considering your spending habits and financial goals, you can determine whether the Citi Strata Premier℠ Card aligns with your needs. For those who find a good fit, this card can offer significant returns and a plethora of benefits that enhance both everyday purchases and extraordinary adventures.

Catch up on the top stories and travel deals by subscribing to our newsletter!