I. Introduction

A. Overview of the American Express® Gold Card

The American Express® Gold Card has long been a prestigious choice for those seeking a premium credit card experience. Renowned for its distinctive metallic design and robust rewards program, the Gold Card is tailored for individuals who prioritize dining and travel. With a history of excellence and a brand synonymous with luxury, it’s no surprise that the American Express® Gold Card appeals to discerning customers looking for more than just a payment method.

B. Purpose of the Article

In this article, we aim to provide a detailed, engaging, and analytical review of the American Express® Gold Card. By examining both the advantages and disadvantages, we will help you determine whether this card aligns with your financial goals and lifestyle. Whether you’re an experienced cardholder or a first-time applicant, this comprehensive review will offer valuable insights into what you can expect from the Gold Card.

C. Brief Mention of the Welcome Gift

One of the most enticing features of the American Express® Gold Card is its generous welcome gift. New cardholders can often enjoy a substantial bonus in the form of Membership Rewards® points, which can be redeemed for a variety of perks, including travel, dining, and shopping. This initial incentive sets the tone for a rewarding journey with the Gold Card, making it a compelling option right from the start.

II. Pros of the American Express® Gold Card

When it comes to credit cards that blend luxury with practicality, the American Express® Gold Card stands out as a top contender. This section will delve into the various advantages offered by this prestigious card, highlighting why it remains a popular choice among discerning consumers.

A. Rewards and Points System

- Earning Points on Dining and Groceries

One of the most compelling reasons to consider the American Express® Gold Card is its robust rewards system, particularly for those who frequently dine out or shop for groceries. Cardholders earn 4X Membership Rewards® points at restaurants, including takeout and delivery, and 4X points at U.S. supermarkets on up to $25,000 per year in purchases. This makes it an excellent option for food enthusiasts and families alike, allowing you to accumulate points quickly on everyday spending.

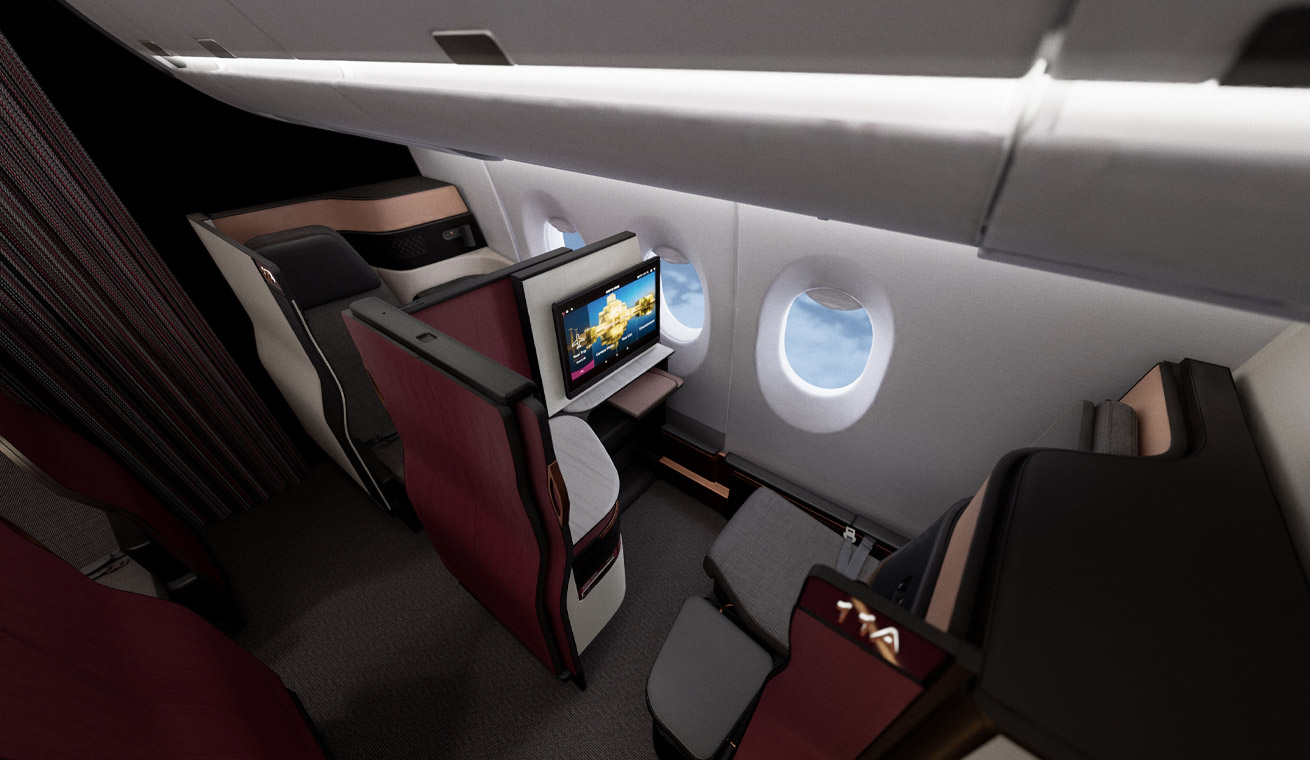

- Travel-Related Rewards

For the avid traveler, the American Express® Gold Card offers 3X points on flights booked directly with airlines or through the American Express Travel portal. These points can be a boon for those who want to maximize their travel experiences, making airfare purchases that much more rewarding. Additionally, the card provides a $100 airline fee credit, which can be used for incidental costs such as baggage fees and in-flight refreshments.

- Redeeming Points for Various Perks

The flexibility in redeeming points is another strong suit of this card. Points can be redeemed for a multitude of rewards, including travel, shopping, dining, and even statement credits. The American Express Membership Rewards® program offers a wide array of options, ensuring that your points can be tailored to suit your lifestyle needs.

B. Exclusive Benefits

- Access to Pre-Sale Tickets and Events

The American Express® Gold Card opens doors to exclusive experiences that money can’t always buy. Cardholders enjoy early access to pre-sale tickets for concerts, theater performances, and sporting events. This privilege can make a significant difference when trying to secure seats to high-demand shows and games, giving you a distinct edge over the general public.

- Travel Insurance and Protections

Traveling with peace of mind is easier with the American Express® Gold Card, thanks to its comprehensive travel insurance and protections. Benefits include baggage insurance, car rental loss and damage insurance, and travel accident insurance. These protections help mitigate the risks and inconveniences that can come with travel, offering financial security and support when you need it most.

- Partner Offers and Discounts

American Express frequently collaborates with various partners to offer exclusive discounts and promotions to Gold Card members. These partnerships span multiple industries, including dining, shopping, and travel, providing cardholders with a range of cost-saving opportunities. Whether it’s a discounted meal at a high-end restaurant or a special rate at a luxury hotel, these perks add substantial value to the card.

C. Customer Support

- 24/7 Customer Service Availability

Customer support is a cornerstone of the American Express experience, and the Gold Card is no exception. Cardholders have access to 24/7 customer service, ensuring that assistance is always just a phone call away. This round-the-clock support is invaluable, particularly in emergencies or when traveling across different time zones.

- Dedicated Concierge Services

The American Express® Gold Card offers dedicated concierge services, providing personalized assistance for a range of needs—from booking travel and dining reservations to securing event tickets. This high-touch service adds a layer of convenience and luxury, allowing you to save time and effort while enjoying tailored recommendations and arrangements.

- User-Friendly Mobile App

Managing your American Express® Gold Card is made simple with the user-friendly mobile app. The app allows you to track spending, redeem rewards, and access customer support, all from the convenience of your smartphone. Its intuitive design and functionality ensure that you can stay on top of your account with ease, enhancing the overall cardholder experience.

In summary, the American Express® Gold Card offers a wealth of benefits that cater to a variety of lifestyles. From a generous rewards system to exclusive perks and top-notch customer support, it provides substantial value that can justify its premium positioning in the market.

III. Cons of the American Express® Gold Card

While the American Express® Gold Card certainly has its allure, it is not without its drawbacks. For every benefit, there are a few potential downsides that might make this card less appealing to some users. Understanding these cons is essential for making an informed decision.

A. Annual Fee

- High Annual Fee Compared to Other Cards

One of the most significant drawbacks of the American Express® Gold Card is its high annual fee. At $250 per year, this fee is considerably higher than many other credit cards available in the market. This upfront cost can be a deterrent, especially for those who are new to credit cards or are not heavy spenders.

- Fee Justification Through Benefits

While the card offers numerous benefits and rewards, not all users may fully utilize these perks to justify the steep annual fee. For instance, if you don’t dine out frequently or travel often, the rewards and benefits might not offset the cost of the card.

- Impact on Budget-Conscious Users

Budget-conscious users may find it challenging to reconcile the high annual fee with their financial planning. If you are someone who prefers a more frugal approach to credit card use, the American Express® Gold Card might not align well with your financial goals.

B. Acceptance Issues

- Limited Acceptance in Some Countries

Another notable downside is the limited acceptance of American Express cards in some countries. While Visa and MasterCard have a broader global acceptance, American Express is not as widely recognized. This can pose a significant inconvenience for international travelers who rely on their credit cards abroad.

- Merchant Preferences for Other Cards

Even within the United States, some merchants prefer to accept Visa or MasterCard over American Express. This preference is often due to the higher transaction fees that American Express charges merchants. As a result, cardholders might find themselves in situations where their American Express® Gold Card is not accepted, necessitating a backup payment method.

- Impact on Travel Plans

For frequent travelers, the limited acceptance of the card can be a critical issue. Whether you are booking hotels, dining out, or paying for transportation, the inconvenience of not being able to use your primary credit card can disrupt your travel plans and add an extra layer of stress.

C. Reward Redemption Restrictions

- Complexity in Redeeming Rewards

The American Express® Gold Card offers a variety of rewards, but redeeming them can sometimes be a complex process. The points system, while generous, may come with stipulations that can make it difficult to maximize the value of your rewards. Understanding the fine print and navigating through the redemption options can be time-consuming and confusing.

- Restrictions on Certain Rewards

There are also restrictions on certain rewards which may limit their utility. For example, some travel-related rewards might only be applicable to specific airlines or hotel chains, reducing their flexibility. This can be frustrating for users who prefer more freedom in how they use their earned points.

- Expiry of Points

Another drawback is the potential expiration of points. While American Express points typically have a long shelf life, they are not immune to expiration. If you do not actively manage and use your points, you risk losing them over time. This can be particularly disappointing for cardholders who have accumulated a significant number of points but have not yet decided how to redeem them.

IV. Conclusion

A. Summary of Pros and Cons

The American Express® Gold Card stands out in the crowded field of credit cards with its impressive suite of benefits and robust rewards program. On the positive side, cardholders can enjoy significant rewards, particularly when it comes to dining and grocery purchases, making it an ideal choice for foodies and everyday shoppers. The travel-related perks further enhance its value, providing opportunities to earn and redeem points that can lead to memorable experiences. Additionally, the card offers exclusive benefits such as access to pre-sale tickets and events, comprehensive travel insurance, and numerous partner offers and discounts, all of which can make life a bit more luxurious and convenient. Customer support is another strong suit, with 24/7 availability, dedicated concierge services, and a user-friendly mobile app that ensures help is always at hand.

However, the card is not without its drawbacks. The high annual fee is a significant consideration, particularly for budget-conscious users who may struggle to justify the cost despite the array of benefits. Furthermore, the card’s limited acceptance in some countries can pose challenges, especially for frequent travelers who need a widely accepted payment method. Additionally, the complexity and restrictions involved in redeeming rewards can be a source of frustration, as can the potential expiry of points if not used in a timely manner.

B. Final Thoughts on the American Express® Gold Card

The American Express® Gold Card is a powerhouse of rewards and benefits, tailored for those who can maximize its offerings and are willing to pay a premium for a superior experience. Its strengths lie in rewarding everyday expenses and providing a host of exclusive perks that can significantly enhance travel and lifestyle experiences. The card’s customer support and user-friendly technology further add to its appeal, ensuring that cardholders have a seamless experience.

C. Recommendation for Potential Users

For potential users, the American Express® Gold Card is an excellent choice if you are a frequent diner, a dedicated grocery shopper, or a traveler who values premium services and experiences. The rewards and benefits can easily offset the high annual fee if you leverage them strategically. However, if you are budget-conscious or frequently find yourself in locations where American Express is not widely accepted, you may need to weigh these factors carefully before committing. Ultimately, the American Express® Gold Card is best suited for those who can fully utilize its extensive benefits and are comfortable navigating its occasional complexities.

Catch up on the top stories and travel deals by subscribing to our newsletter!